machinaquanta.com ← analytics site & education for subscribers (reach out to me if you want access)

Mon. Mar. 31

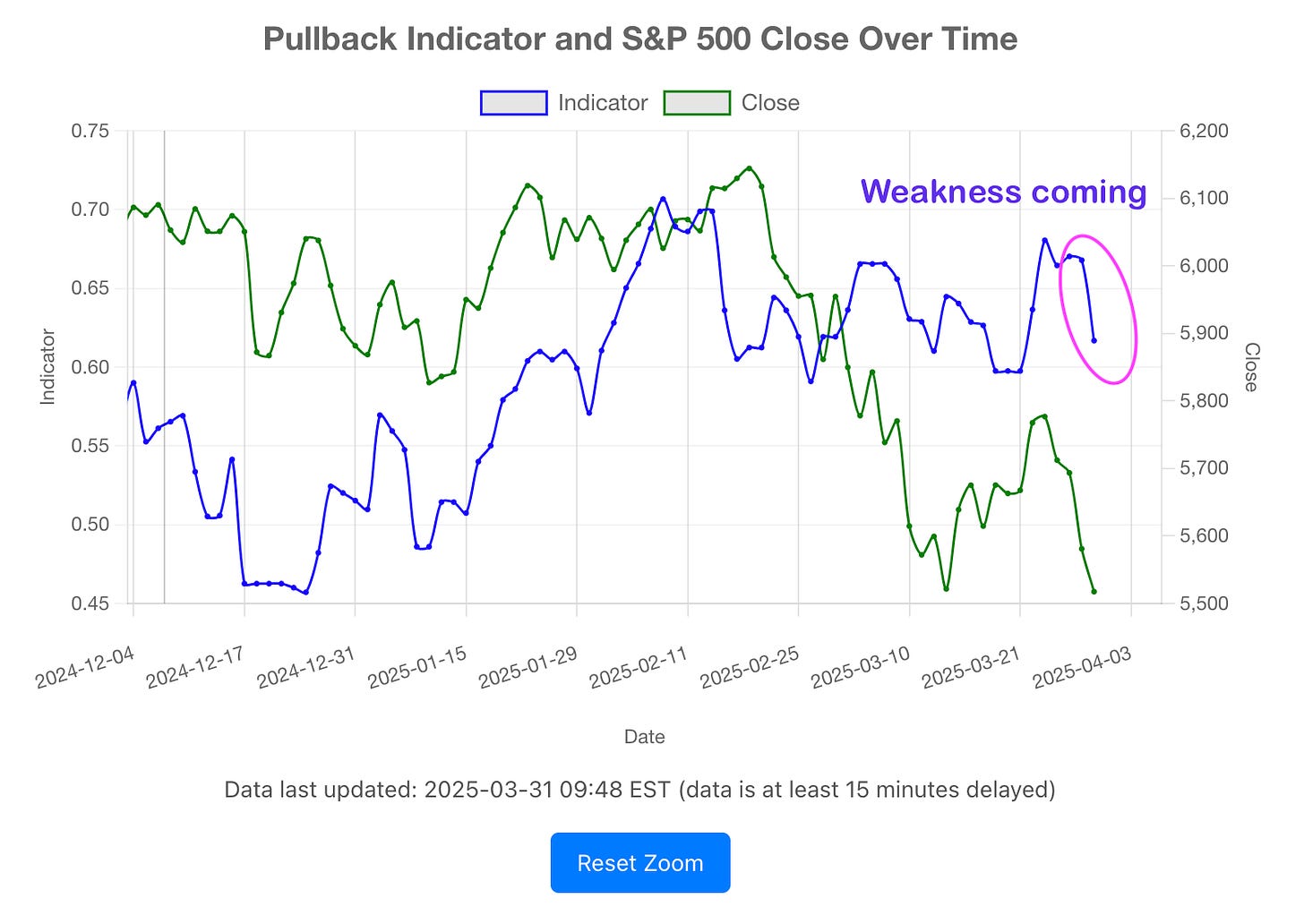

Was Monday our bottom? For weeks I have been saying, and I reiterated again in the chat, that I want:

“Now the last ingredient I was looking for from a while back was: gap down and red -> green day.”

Let’s analyze the picture above and my thought process for Monday. We had:

Gap down + red (sell) to green (buy) - exhausted sellers (globalists?)

VIX made a lower high (see Education section on machinaquanta.com) - divergence

GEX (although not real time but I estimated) would no way make a lower low. In the end, it GEX made higher low almost exactly where I drew the pink circle below - divergence

Double bottom on technicals (traders pay attention to this so I have to)

My tin hat analysis looking through charts over past decade showed most bottoms curiously occurred on Monday, Thursday or Friday. I have no formal statistics calculated to back this up. But what were the chances that it was this Monday I thought.

SPX did not reach my lower box ~5400. I felt there were too many eyes on Fintwit looking at this area so I suspected we would get front run here - spoiler, we did get front run.

For transparency I also noted where I made past purchases in SPX (yellow circles) so nobody confuses me for a ‘bottom finder’ expert - I’m not. My edge is finding pullbacks and tsunamis, the stuff that nobody looks for or is interested in.

GEX

I didn’t want to wait until we completely go green as VIX spiked and it juiced up the April puts so I ended up closing the hedge for the reasons above. The index could still go down from there, of course, but it was very unlikely VIX would continue spiking as VIX needs a reason to stay bid as they say. The puts went from $47 to ~$89 (89% return), not bad for a hedge where I did nothing for 2 weeks.

Next, I took a new position in IBIT (Bitcoin ETF). From the chat my rationale was:

I am interested in adding IBIT today (BTC) instead of adding to SPX for:

-more torque

-it's somewhat a levered play on NDX (without the drag of semis)

-it has outperformed NDX relatively on the way down.

So if/when we go back up it should have some good performance.

NDX vs IBIT (Daily Relative Prices)

From the chart above, you can see that very recently IBIT performed relatively well compared to NDX. There is some seasonality as well (although limited) to also add confluence to the idea. As well from the chat:

I am already long SPX at this level from 2 weeks ago so I'm indifferent about that. But I like the BTC proxy as another long….

There is also research that shows the highest return is in the top quantile momentum names - if following a momentum based strategy. From that perspective I think it's [BTC] better odds than buying NDX here on an upswing. So a combination of momentum strategy and relative performance.

Lastly, I added a small hedge which you can see in the chat. My rationale was:

Taking small hedge on Apr 11 5600-5500 SPXp (~35) spread. Just in case the model sees something I don't. Rolling some of the hedge wins into this, prepared that it goes to 0. Literally nobody is putting on this trade, everyone is buying calls it seems so keep in mind.

This was the model output towards the close on Monday. I wasn’t interested when SPX had already gapped down, however by end of day SPX rallied into the close (my favourite setup) and it made me too antsy to not take a small position.

Tues. Apr. 1

Tuesday can be summarized in two pictures as we awaited the tariff announcements. Despite the change to bullish sentiment and most indicators pointing to reversal, SPX STILL gapped down and sold off 50 handles next morning (pick any reason why) ha! - good job model. I should have closed the puts but it’s too small to really care and I had just added a long in IBIT.

Then in the morning, the model showed stabilization or buy the dip. To no one’s surprise, SPX ripped back up (pick any reason why).

What’s Next

Keep reading with a 7-day free trial

Subscribe to Machina Quanta to keep reading this post and get 7 days of free access to the full post archives.