machinaquanta.com <- analytics site

Since reaching 100 subscribers, thank you btw, I wanted to give back to the community. So, I’m giving away complimentary 1-week trials to my analytics site, machinaquanta.com (aka Bender) if you'd like to play around with it. If interested in this feel free to respond to this thread or reach me on Substack or chat. First, let’s offer you some free education on using Bender (our quant machine) below.

Free Education - Patterns from Bender

Through developing and tweaking Bender, I’ve found some important patterns that I wanted you to be aware of that Bender outputs. These have been red flags for me where I usually look to hedge/short, just in case. They are linked directly below.

Important: I don’t follow Bender blindly and neither should you, it’s just a tool. We want a confluence of factors to help our decision making, ideally we look at:

Bender

GEX

Technicals (support/resistance levels)

VIX or other vol measures

Seasonality

Others (e.g., contra Jim Cramer)

Now onto the review.

Weds. Mar. 12

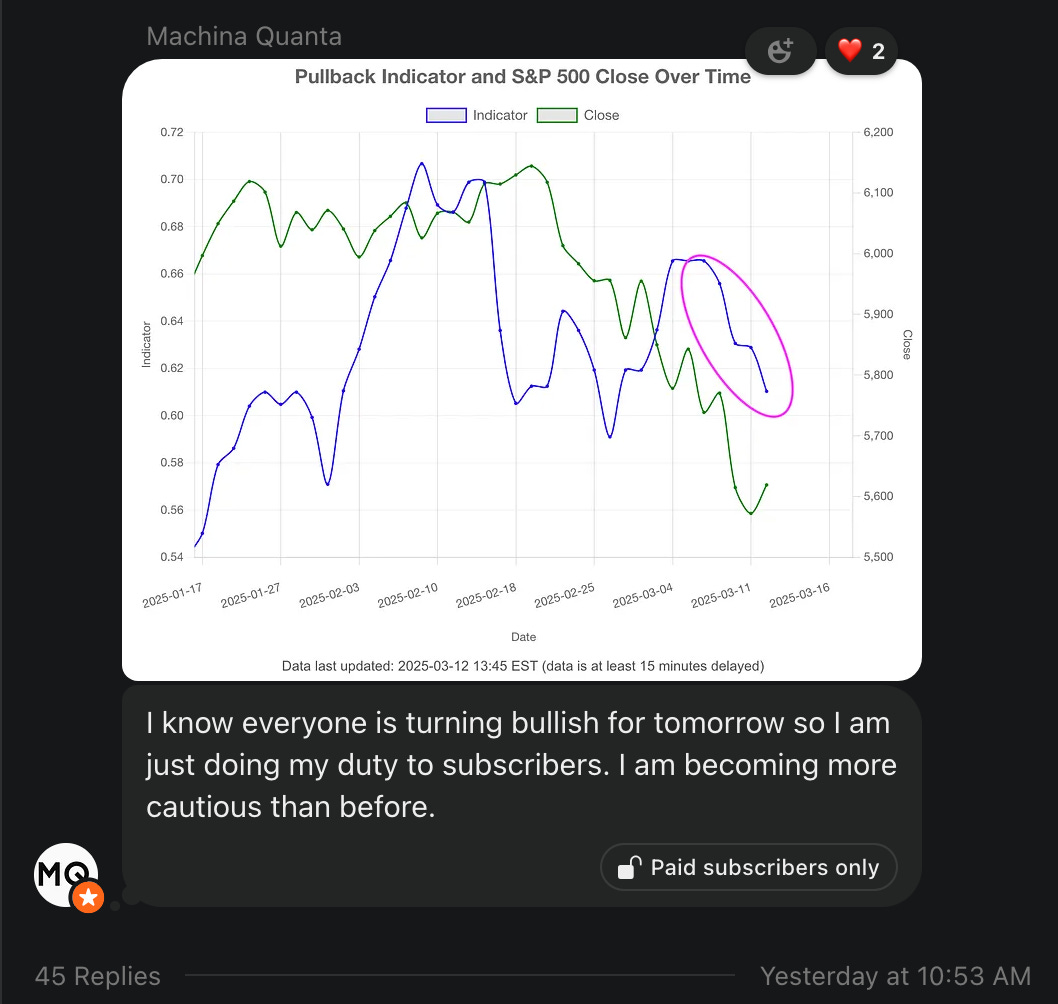

Markets attempted to rally on [input literally any economic news] (it doesn’t really matter) and Bender, nor I, believed the pump job. Not surprisingly this was my morning update below. You can guess how the rest of the day went - not well for bulls.

One thing to note is that we had entered negative gamma exposure (GEX) which coincides with increasingly more violent price moves intraday. As well, GEX was also reaching a fairly pivotal area where bounces have occurred not too long ago.

Thrs. Mar. 13

After two days of Bender signalling sell off, SPX finally reacted today and sold off +100 handles right into the close. Interestingly, Bender saw something was off about the sell off today. So, my morning update was:

We have weakness this morning as per Bender's last update from yesterday so we are not too surprised. However, this morning the sell signal that was being generated over the past few days has now stopped. So it shows upcoming stabilization - I don't know when but it can take a few days.

Visually here is what that looked like for more clarity from machinaquanta.com.

A few other important statistics I mentioned in the chat.

Seasonality

Upcoming seasonality to keep in mind. Look at the strongest semi-weekly periods for highest probability long setups. Meanwhile, the next 4 weeks is generally poor/low probability for bulls.

Below is the chart that shows some of the semi-monthly periods and the average returns. Note H2 April is the highest probability setup for bulls. It’s not a science by any means but bulls tend to have help during that time period it seems. However, we are now entering H2 March which is also not a terrible time for bulls, not amazing but also not horrible.

GEX again decreased and reached a very low level which has preceded bounces. This is what I am counting on. Is it a bottom? No idea but it sure is a high probability area for a bounce.

What’s Next

Keep reading with a 7-day free trial

Subscribe to Machina Quanta to keep reading this post and get 7 days of free access to the full post archives.